How to Use Moving Averages for Stock Tips

Moving averages are one of the most popular and beginner-friendly tools used in technical analysis. Whether you’re new to the Indian stock market or exploring ways to improve your trading decisions, learning to use moving averages can help simplify stock tips and boost your confidence.

What Are Moving Averages?

A moving average (MA) smooths out price data by averaging past prices over a selected period. It helps filter out market noise and identifies trends.

Common Types:

- Simple Moving Average (SMA): A basic average of closing prices over a period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive.

Why Moving Averages Matter for Stock Tips

Moving averages help:

- Identify the trend direction (uptrend or downtrend)

- Generate buy/sell signals

- Filter out false signals

- Confirm tips from other sources or indicators

Key Moving Average Strategies for Beginners

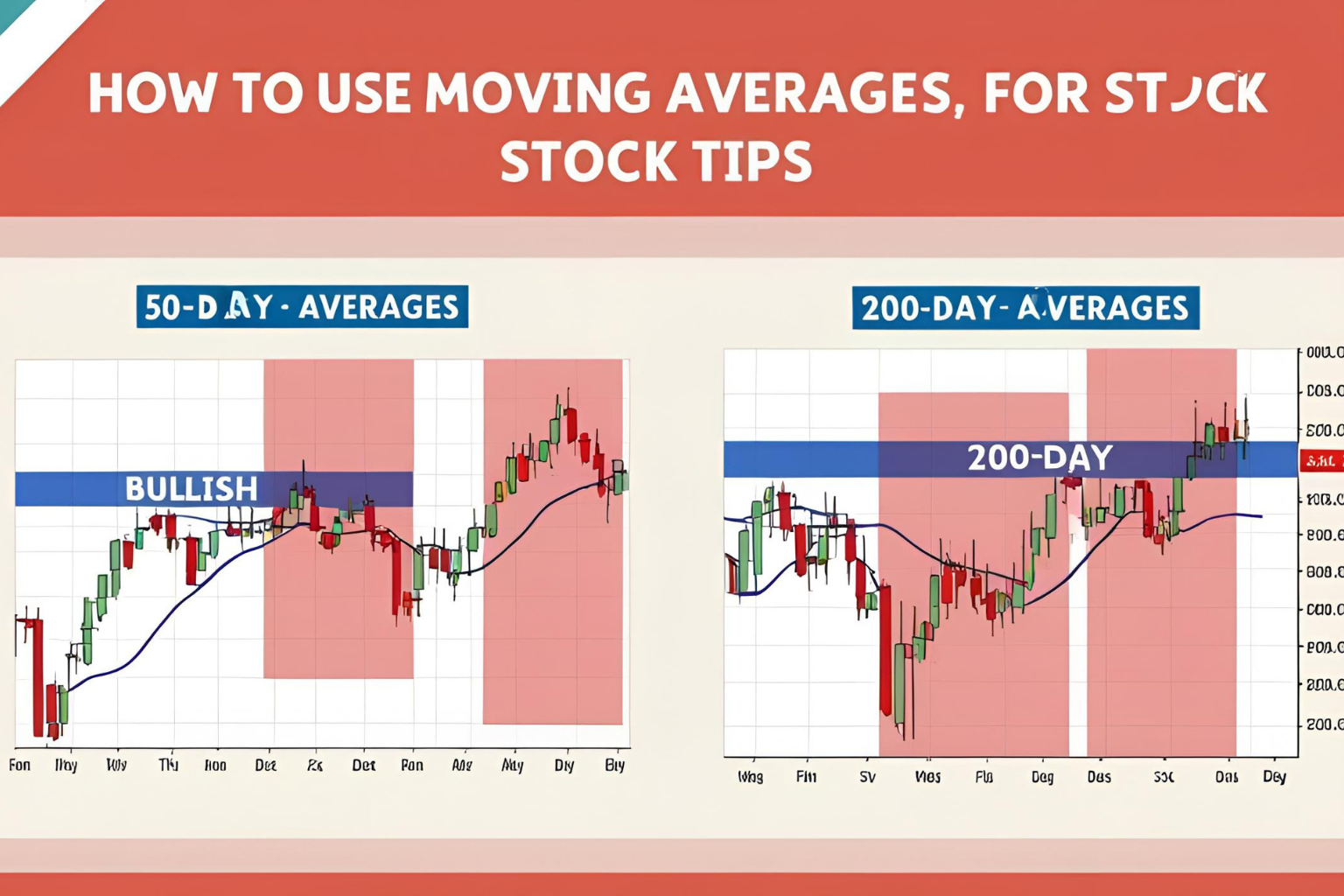

1. Using the 50-Day and 200-Day SMA

- If the stock price is above both MAs → bullish trend

- If the stock price is below both MAs → bearish trend

- When the 50-day SMA crosses above the 200-day → Golden Cross (buy signal)

- When the 50-day SMA crosses below the 200-day → Death Cross (sell signal)

2. Using EMA for Short-Term Trading

- The 20-day EMA is commonly used for short-term tips

- Look for stock tips where the price bounces off the EMA as support

- A price closing above the EMA can suggest a strong entry point

How to Combine Stock Tips with Moving Averages

Let’s say you get a tip about a stock expected to rise:

- Check the trend using 50-day and 200-day SMA

- Verify short-term strength with 20-day EMA

- If the tip aligns with the trend, it adds confidence to act on it

Example: If a stock tip suggests buying Reliance, and the stock is above its 50-day and 200-day SMA, it confirms a strong trend.

Tools to Use Moving Averages Easily

- TradingView: Charting platform with MA indicators

- Zerodha Kite: Popular for Indian users

- Moneycontrol & Screener.in: To track stock data and trends

Tips for Beginners

- Don’t rely solely on moving averages—combine with volume and news

- Avoid tips on stocks with sideways or choppy price action

- Use stop-loss to manage risk, even on confirmed signals

- Backtest strategies on past charts to build confidence

FAQs

Q1: Which moving average is best for beginners?

Start with the 50-day and 200-day SMA for long-term investing, and 20-day EMA for short-term insights.

Q2: Can moving averages predict stock prices?

Not exactly—they help identify trends, but can’t predict exact price movement.

Q3: Should I use moving averages alone for stock tips?

No, combine them with other indicators or fundamental analysis for best results.

Q4: How do I add moving averages in TradingView?

Click “Indicators” → search “Moving Average” → select and set your desired period (e.g., 50 or 200).

Q5: Are moving averages useful for intraday stock tips?

Yes, but use shorter timeframes like 5- or 15-minute EMAs in that case.