Swing Trading Tips for Indian Beginners

Swing trading is a popular strategy among part-time traders in India who want to profit from short- to medium-term price movements. It involves holding a stock for a few days to a few weeks to capture “swings” in price trends. If you’re new to trading, this guide will help you get started with smart, simple tips tailored for Indian markets.

What Is Swing Trading?

Swing trading sits between intraday trading and long-term investing. Unlike day traders, swing traders don’t exit positions on the same day. They analyze price trends and technical setups to profit from uptrends or downtrends over several sessions.

Why Swing Trading is Great for Beginners

- No need to monitor charts all day

- Less stressful than intraday trading

- Fits well with part-time or evening market study

- More opportunities than long-term investing

Top Swing Trading Tips for Indian Beginners

1. Trade in Liquid, Mid-to-Large Cap Stocks

Avoid illiquid or micro-cap stocks. Choose stocks with high daily trading volume from the NSE 500 or Nifty 50 list. Liquidity ensures easy entry and exit.

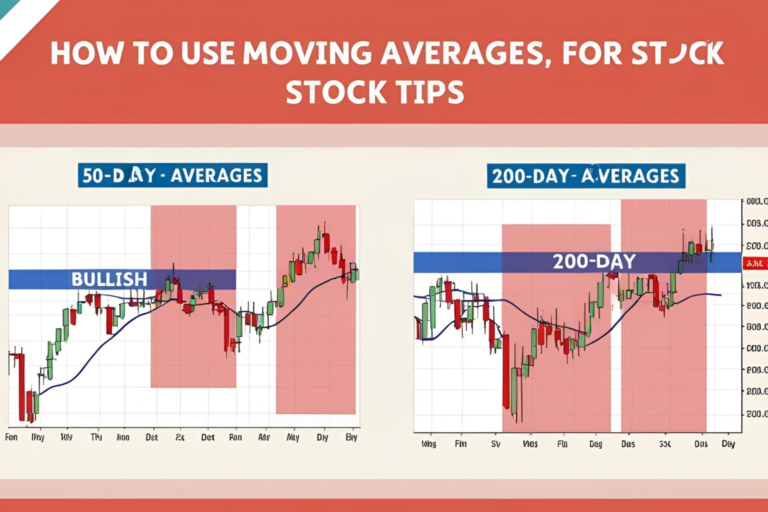

2. Use Moving Averages for Trend Confirmation

A stock trading above its 20-day or 50-day EMA is often in an uptrend. Combine this with support and resistance levels for more confidence.

3. Focus on Price Action Near Support/Resistance

If a stock bounces near a known support level or breaks resistance with volume, it may offer a good swing opportunity.

4. Limit Exposure to 2–3 Trades at a Time

Don’t overload your portfolio. Beginners should start with one or two swing trades to avoid confusion and manage risk better.

5. Always Use Stop Loss

Protect your capital. Set a stop loss based on chart patterns or a fixed percentage (e.g., 2–3% of trade value). Stick to it.

Best Timeframes for Swing Trading in India

- Daily chart: For trade planning and entries

- Hourly chart: For fine-tuning entry/exit

- Weekly chart: To understand broader trend context

Common Swing Trading Mistakes to Avoid

- Entering without a plan or exit strategy

- Chasing stocks after a big move

- Ignoring earnings dates or major news

- Over-trading based on tips without confirmation

Tools for Swing Trading in Indian Markets

- TradingView: For technical charts and indicators

- Screener.in: For fundamental filters

- Moneycontrol or NSE India: For stock data and news

- Broker Platforms (Zerodha, Upstox, Angel One): For placing trades

Example: A Simple Swing Trade Setup

Stock: HDFC Bank

Setup: Price bouncing off 50-day EMA with strong volume

Entry: ₹1,500

Target: ₹1,580

Stop Loss: ₹1,470

Holding Period: 3–5 days

FAQs

Q1: Is swing trading suitable for full-time employees?

Yes, it’s ideal for part-timers. You can analyze and place trades after market hours.

Q2: How much capital should I start with for swing trading?

Start with ₹10,000–₹25,000 and scale up as you gain confidence and results.

Q3: What indicators are best for swing trading?

EMA, RSI, MACD, and support/resistance levels work well for swing setups.

Q4: Can I do swing trading with delivery trades?

Yes, swing trading is often done via delivery-based positions, especially in cash segments.

Q5: Are penny stocks good for swing trading?

Not recommended. They are often illiquid and volatile without clear trends.